UPDATE June 2019: Effective September 22, 2019, Citi cards will no longer provide Trip Cancellation and Interruption coverage. Please consider purchasing travel insurance* to protect you from situations like ours!

Travelers beware! If you opened a Chase Sapphire®† card because of the advertised travel benefits, keep reading. Despite being routinely crowned the best credit card for travelers, Chase®† travel insurance fails miserably. Relying on this card in a travel emergency–like a terrorist attack or natural disaster–can leave you stranded or cost you thousands.

Travelers Choose Chase Sapphire Card for Travel Insurance

Many travelers who don’t need all of the components offered by a comprehensive travel policy are relying on the travel insurance provided by their credit cards to avoid coverage redundancies. Makes sense, right? Why pay for additional coverage that you already have? After being bombarded by propaganda declaring the Chase Sapphire card as the best card for travelers, I opened one.

I even reviewed the Guide to Benefits. I checked for sufficient coverage limits, covered reasons, and exclusions. Nothing unusual was mentioned. Unfortunately, it’s the stuff Chase doesn’t mention that is the problem.

Keep reading and I’ll tell you what Chase and its travel partners won’t…even if you ask in the middle of travel crisis.‡

Imagine for a moment that you are traveling with your family halfway around the world.

For months, you have planned every detail of your dream trip–maybe it’s an African safari, a Galapagos adventure, or exploring the beaches and temples of Thailand. Just as you’re about to board your flight, every TV monitor in the airport goes to the same breaking story:

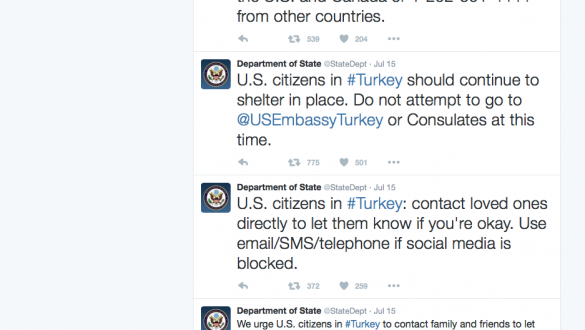

A series of violent attacks is unfolding in your connecting city.

Bombs are exploding around the city and the airport. Streaming news footage shows travelers huddled and praying under desks and chairs in the exact airport that the flight you are boarding is heading.

Unfortunately, we didn’t have to imagine it. We lived it.

What would you do? Would you cancel your vacation entirely? Or would you reschedule your flights to avoid the connecting city?

A travel crisis like this highlights the importance of understanding the difference between Trip Cancellation coverage and Trip Interruption coverage and ensuring you have adequate coverage for both.

What’s the Difference between Trip Cancellation and Trip Interruption?

Many travelers use the terms “Trip Cancellation” and “Trip Interruption” interchangeably, as if they are the same thing. They are not. And the differences are critical.

Trip Cancellation means that something happens (usually before your trip begins) and you need to cancel your trip. The covered reasons vary from policy to policy, but Cancellation means you won’t be using your lodging, transportation, tours, etc., and are seeking a refund for those prepaid expenses.

Trip Interruption means that something happens during your trip that disrupts your plans. Trip Interruptions may include unexpected events like terrorist attacks, injury during the trip, death of a family member, natural disasters, etc. Because these are interruptions that occur during the trip, Trip Interruption Coverage typically includes both Cancellation for the unused lodging/tours/transportation PLUS the Additional Expenses that are incurred due to the Interruption.

Examples of Trip Cancellation vs. Trip Interruption

For instance, if you are on a cruise and a family member passes away unexpectedly, you are faced with trying to find a last minute flight back home from a different airport than planned. Trip Cancellation may reimburse you for the unused cruise/lodging/tour part of your trip but it won’t cover your last minute flight home. That is what Trip Interruption is for.

Or if you are vacationing in Bali when a volcano erupts and you must evacuate, Trip Cancellation may cover your unused lodging/tours, but it will not cover the additional expenses to evacuate. That is where Trip Interruption comes in.

Or, like in our case, just before boarding your flight to South Africa, a violent uprising breaks out in Istanbul (your connecting city) and the airport is under attack. In this situation you would have two options: 1) Cancel your trip and utilize the Trip Cancellation benefits to get refunded for your entire trip, or 2) utilize the Trip Interruption benefits to book alternate flights to Africa and not cancel the entire trip.

Which option would you choose?

Although this shouldn’t be a trick question, it IS if you have the Chase Sapphire or Chase Marriott®† card.

What Chase Won’t Tell You about Their Travel “Benefits”…Even if You Ask

Despite four separate phone calls–totaling more than 45 minutes in length–to Chase and its travel benefits partners on the day of the attacks in Istanbul, not one representative disclosed that their Trip Interruption “benefits” do not include alternate transportation…

Even when I specifically asked.

Instead of disclosing that they don’t actually provide the industry standard Trip Interruption coverage, Chase’s representatives informed me that we had $5,000-10,000 in Trip Interruption benefitsˆ and to book our alternate flights to Africa and then file for reimbursement.

I placed six phone calls over a three day period to Chase and its partners. Phone calls in which I sought benefits information and claims assistance. Despite my asking about additional transportation expenses, and then informing them when I had booked alternate flights to Africa at an additional expense of over $5,000, they still failed to disclose that those expenses were an unwritten exclusion in the policy and would be denied. After Chase’s representatives implied that our alternate flights to South Africa would be covered, we chose to not cancel our trip.

However, during my conversations with Chase’s partners, they were sure to add a disclaimer stating that only a “licensed adjuster” could interpret benefits. Yet I was never given the opportunity to actually speak to a licensed adjuster.

It was a brilliant strategy on their part.

It reminded me of the super-fast, high-pitched legal disclaimer that you hear at the end of attorneys’ commercials. By using this tactic, Chase and its partners avoid having to give actual critical policy information to travelers in their moment of crisis.

In our experience, no matter what Chase’s representatives say, imply, or fail to disclose, as long as they add the CYA statement about the licensed adjuster, they take no responsibility for the consequences.

Chase Travel Insurance Partners

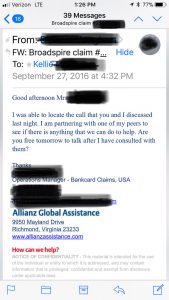

Chase partners with Allianz®† Global Services (AKA “Visa Card Benefit Services”), Broadspire®†, and Chubb®†/Federal Insurance Co. to underwrite and administer its travel claims. All are well known companies within the insurance world. Allianz and Broadspire are also members of the U.S. Travel Insurance Association, whose code of ethics requires them to “Present its products, benefits, conditions, exclusions and prices clearly and accurately” and “Conduct business in good faith, according to the highest standards of honesty and fairness.”

Why does this matter?

Chase’s Trip Interruption coverage excludes the single major component of Trip Interruption coverage–Additional Transportation Expenses–yet they did not disclose it verbally or in writing.

So how exactly is a traveler supposed to know this in the middle of a travel emergency?

Why is Additional/Alternate Transportation So Important in Trip Interruption Coverage?

It is the unexpected transportation expenses that can cause a financial wreck due to a trip interruption. Having to book last minute flights to anywhere can cost a small fortune. This is why Alternate Transportation/Additional Transportation Expense is the cornerstone benefit in Trip Interruption coverage.

Benefits for alternate transportation are as essential to Trip Interruption coverage as brakes are to a rental car.

A review of 38 comprehensive travel policies on InsureMyTrip.com*, confirms that every single one provides for the Additional Transportation costs associated with a trip interruption.

Every. Single. One.

Maybe you’re thinking, “But those are paid policies, of course they are going to cover stuff that a free credit card perk policy wouldn’t.”

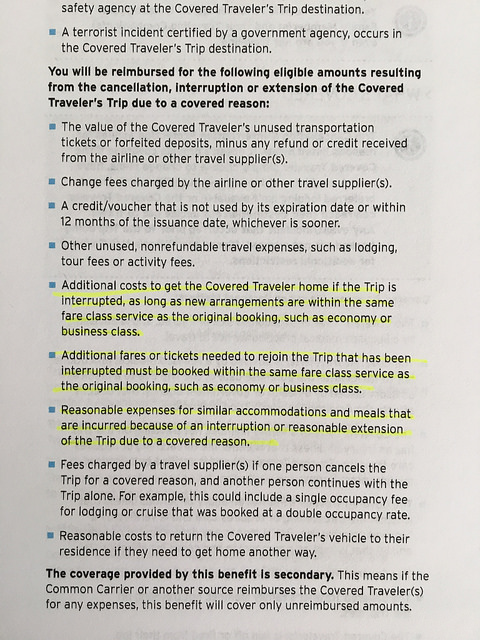

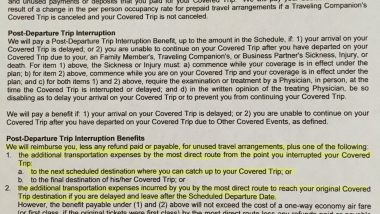

Wrong. Even the Citi®† AAdvantage®† card provides for “additional fares or tickets needed to rejoin a trip that has been interrupted.”§

In fact, over the past 18 months, I have reviewed over 40 different travel policies, both free ones provided by credit cards and independently purchased policies. Of those, only Chase’s does not include Additional Transportation Expenses.

Trip Interruption Coverage without Alternate Transportation is Like Renting a Car without Brakes

Trip Interruption coverage with an unwritten exclusion of alternate transportation is akin to a rental car company “forgetting” to disclose to you that the car you just rented doesn’t have brakes.

Consider this:

You’re renting a car from a major rental car company, and while you’re checking out you ask, “Hey this car has brakes, right?”

And the rental agent responds, “Of course it does!”

And just as you’re leaving the lobby she quickly adds, “Only a licensed mechanic can actually tell you if it has brakes.”

You wouldn’t think much of it would you? I mean really? What company would rent a car without brakes? And even if they did, wouldn’t they have a duty to disclose it? Especially when asked?!

And then when you crash and get badly injured while driving the car without brakes, the rental car company’s response to your medical bills payment request is:

“We TOLD you only a licensed mechanic would know if the car had brakes. It’s YOUR fault for driving the car.”

That’s the kind of conversation and travel coverage you can expect if you have Chase travel insurance.

Why Does Accurate Benefits Information in the Moment of Crisis Matter?

Sadly, Chase’s non-disclosure cost us nearly $6,000 in additional expenses. If Chase and partners had disclosed that they do not provide the industry standard benefit of Additional Transportation Expenses, we would have chosen to cancel our trip and file a Trip Cancellation claim. That would have cost them significantly more than $6,000.

Is it just me, or do you smell a rat too?

By implying, but not confirming, that alternate flights would be covered, Chase and partners were able to deny our Trip Interruption claim and avoid a very expensive Trip Cancellation claim.

Innocent omission? Or intentional misrepresentation? Either way–it stinks.

What Should You Do if You Have a Chase Card for Travel Insurance?

- You can do what we did: cancel all Chase accounts and use the old cards for target practice.

- If you still want to use your Chase card for travel, consider purchasing a separate comprehensive policy that will actually cover you if things go wrong. I like InsureMyTrip.com*.

- a)

Use a credit card such as the Citi AAdvantage card to cover Trip Cancellation and Trip Interruption; and b) get a MedJet membership* to cover medical evacuations on an annual basis. Finally, if you are leaving the country, c) consider a travel Medical policy* to cover any hospital expenses if you get sick abroad. - Be sure to thoroughly read the terms and conditions to make sure that the policy has all of the coverage that is right for you. Do NOT rely on fancy marketing propaganda or website recommendations.

Travelers Deserve Accurate Travel Insurance Information During a Crisis

After more than a year of challenging Chase and partners’ handling of our travel crisis, they have made it clear that they believe it was handled appropriately.

Call me crazy, but I don’t think it is unreasonable for a traveler to expect to be given the critical benefits information required to make an informed decision in the middle of a travel crisis. Do you?

Before you book your next trip with your Chase card, ask yourself this:

If Chase and its travel insurance partners will not provide critical policy information when bombs are exploding at your destination, do you think there is any situation in which they would?

If you’ve had a similar experience with Chase travel insurance, we’d love to hear about it! Please scroll to the very bottom of the page to comment.

Don’t Get Stranded by Chase Travel Insurance! Get a Quote for Real Travel Insurance Instead

Ready to explore the world? Then check out THE PASSPORT PROJECT and THE ULTIMATE TRAVEL TRACKER to inspire and manage your wanderlust.

Interested in more epic adventures? Check out the following:

- Camping in Antarctica: Everything You Need to Know to Survive

- How to Save Thousands on Your Family’s Galapagos Adventure

- Ten Day Namibia Road Trip: Sand, Seals, and Safari

- How to Plan a Budget Vacation to the Luxurious Maldives

- How to Book an Amazing and Affordable South Africa Safari

- No Regrets: Bungee Jumping in Queenstown, New Zealand

- The Passport Project: A DIY Journey Around the World

Interested in more cultural adventures? Check out following:

- Three Tips for Ethically Visting Myanmar‘s Long-Neck Women

- How to Volunteer at Delhi’s Gurudwara Bangla Sahib Sikh Community Kitchen

- Burial, Cremation, and Reincarnation in Bali

- Learn to Meditate at Truc Lam, Da Lat, Vietnam’s Buddhist Monastery

- Family Travel Idea: Spend the Night with the Embera Puru Indians in Panama

- Don’t be Flashy! Guidelines for Luang Prabang’s Alms Giving Ceremony

- Cambodia‘s Genocide: What I Never Learned in School

[…] first aid kit; easy access to physician consultations back home; and a *MedJet membership and travel insurance for true emergencies (*affiliate […]

We had booked a Mediterranean cruise for March 2020 in June 2019. We actually did fly to Barcelona. On March 19th, 2020, we boarded the MSC Grandiosa. Four hours after boarding, the Captain demanded that the passengers who had just boarded, to disembark, as the ship could not return to any port in Spain. We could not reach our airline, to change our reservations to fly home earlier. We had to buy new tickets to fly back to the USA. They were not outrageously expensive but they were another expense that was unplanned.

Our cruise was booked and paid on the Chase Sapphire Reserve CC. We also had purchased separate travel insurance as my SO has medical conditions. We received NO assistance from Chase or Seven Corners Insurance. We filed claims with both. All claims were denied because they stated that pandemics are not covered. Even tough pandemics were not mentioned as being specifically excluded. We filed claims with the IL Attorney general. They supported the insurance companies. The whole thing was a fraud. To me, the idea was that we we should have received some kind of assistance with our trip. WE RECEIVED NOTHING FROM CHASE!

My Sapphire Reserve is being canceled after my next trip, as I have some things that are paid with it. But I am done with the Sapphire Reserve next year.

I feel ya! I don’t know how they can get away with it. I had a similar-but-different experience and also filed a complaint with the AL Dept of Insurance, and they stood behind Chase as well. I still cannot believe that if there is a pandemic order or terrorist event taking place at the airport you’re headed to, the insurance company has NO OBLIGATION to provide accurate policy details so you can make an informed decision about how to proceed. How is that legal?!

There are clearly big loopholes for travel insurance companies to use, to not pay benefits. It is disgusting! I blame the travel insurance companies more than Chase, as they write the policies.

What is remarkable is how the insurance companies changed and included Covid after May 1st, 2020. Because if they didn’t include Covid, they could not sell policies. Customers were demanding Covid be included.

It’s interesting, I just found this article and went to read the current terms and conditions. Seems they had enough people complain, so it is now listed in plain language (if you read the terms) that they will only cover change fees for travel interruptions, and not additional costs. Still terrible that they don’t provide that standard benefit and yet market the card as including trip cancellation and interruption, but at least it is in the terms now.

Thank you, Alyssa, for the update to their T&C. It’s good that they’re being slightly more transparent about their inadequate coverage.

So, I was thinking I didn’t need to purchase travel insurance since I have sapphire card and has travel insurance. So basically, your saying I do need traveler insurance to play it safe. Which travelers insurance do you preferred and why? Please help me out looking for annual coverage I’ve read so much that my eyes are bleeding red. I’ve tried to compare insurance but I cannot for the life of me understand all the small print. Basically, looking to be covered for airlines, cruises and just plain vacationing so that I’m not all freaked out about insurance plans. We are from Texas senior citizens, retired military. Please can you give me guidance in simple terms how to go about finding adequate travelers insurance. Any recommendations would be very, very helpful.

Hi Rosa,

Yes, unfortunately Chase will leave you hanging in the event of any sort of Interruption. I am not an insurance representative, but I always purchase through Insure My Trip (no-cost-to-you affiliate link). I use the filters to select what I need for each trip. The main thing is making sure you have Interruption and Medical coverage that will cover extra flights, accommodations, and/or treatment in the event of an emergency. I know the fine print is mind numbing! I also email/chat with the representatives from Insure My Trip and they do a good job of answering my questions. Good luck!

Looks like Citi has dropped the travel coverage from their cards as of late 2019…Is that why your suggestion to use a Citi Aadvantage card is now crossed out? FWIW, we like Squaremouth more than insuremytrip for finding travel coverage. They seem to allow more input for variables, and display of coverage types and amounts, so you can more easily choose something that suits your preferences (like greater medical coverage and evacuation limits).

Couple of questions based on your experience:

1) If you had canceled the trip entirely in the beginning is it more likely that Chase would have paid for all losses incurred?

2) Let us assume that there was a major problem in South Africa (rather than Turkey your intermediate transfer point) and you went all the way to Turkey. If you had canceled the rest of your trip (hotels, flights etc) and rebooked from Turkey to USA, do you think that trip interruption would have resulted in payment for all losses incurred, including your return trip back to US?

What I am trying to get at on the 2nd point above is, was Chase only not using the same definition of trip interruption if it happens at the origin, since it is still considered your home for departure purposes, but would pay if your trip is interrupted outside home? I am not saying that is the correct definition for insurance purposes, but just trying to understand the basis for denial.

Hi Sam,

Thanks for reading and great questions! Let me try and answer them:

1) Yes, if we had canceled our trip while in the Atlanta airport, ALL of our expenses would have been reimbursed–flights, hotels, etc. The REASON for our interruption was approved (and if we had canceled it would have approved too). But since we didn’t want to cancel our trip, we just needed to get to South Africa a different way. And that is where Chase failed us. They don’t provide coverage for additional expenses that are incurred due to an interruption (which is industry standard BTW). In retrospect, we should have just canceled the entire trip and gotten all of our money back. Then rebooked for a later date. And we would have done this if Chase had not misrepresented their coverage and lead us to believe that they provided coverage for interruptions.

2) In this scenario, Chase would have reimbursed us for the prepaid expenses that we were canceling, but they would NOT have paid for our return trip to the US. So in reality, they don’t actually provide Trip Interruption coverage, they only provide Trip Cancellation coverage. The issue wasn’t that we were still in the USA; the issue is that they do not provide for any sort of additional transportation expense that is caused by an interruption. They will only reimburse for expenses that have to be canceled due to an interruption.

I hope this clarifies things. Bottom line: Don’t rely on Chase for travel insurance. It’s just not worth it.

Thank you so much for the clarifications Kellie, I understand how chase works.

You’re welcome!

You think it would clarify, but I still don’t know if you were in South Africa already, and some coverable event happened and you had to return home early – assume you could change return flight day/time – you would not be reimbursed for any change fees? And, if you had to cancel the flights and rebook a return with a completely different carrier, you would be reimbursed for return flights that were canceled, but they wouldn’t cover the new flights?

[…] bombs being dropped around you and your airport is under siege), you will still not be covered. Read this blog post for more […]

Thank you for writing this piece. I knew we would not be the only ones scammed by Chase’s travel protection. A quick Google search brought this post up immediately.

Chase Sapphire Reserve card and their “travel protection” partner is a complete scam. Please do not get this card. It is NOT worth the $450 annual fee because it’s a total ripoff and scam.

We travel internationally a lot and THE main thing that got me to sign up for this card was the travel protection.

We booked one way tickets to Europe in Dec 2018 for a trip planned for May 2019.

In March 2019, we found out that my dad was diagnosed with stage pancreatic cancer and given 6 months to live by his doctor.

Naturally, we could not go on our Europe trip and by early May we had to transfer him to a full time home and hospice care. I submitted a claim in late April telling eclaimsline (Chase’s trip protection insurance partner) we will not be able to make that trip and submitted all paperwork they required. From physician’s statements to his hospice doctor’s note requesting us to remain at his bedside.

First of all, they kept losing the paperwork we submit through their portal so between my accountant and I, we’ve had to upload multiple requests for the same documents at least three times each.

After almost 4 months of back and forth, eclaimsline denied the claims saying my dad’s condition was pre-existing.

Yes, Chase’s travel insurance partner eclaimsline is now also an Oncology department. They can diagnose cancer and illness on your behalf too because that’s exactly what they did.

If my situation with my dad does not qualify for a claim, then nothing else will.

It’s a scam. Chase Sapphire Reserve, eclaimsline travel protection. Do not get this card. I will not be renewing ours.

Luanne, I am SO sorry for your dad’s diagnosis and your horrible experience with Chase! Thank you for sharing your experience because you’re exactly right: if your situation doesn’t qualify for cancellation coverage then I don’t know what would be.

Like you, we travel a lot and their so-called Trip Cancellation and Interruption coverage is the reason we opened the account. “Scam” is the only word to describe it. I immediately closed all Chase accounts and will never do business with them or any of their travel partners again.

Again, I’m so sorry about your dad.

Thank you Kellie – I want to clarify that it’s stage 4 pancreatic cancer. I realized that number was left out.

Pancreatic cancer is usually only detected when it’s late stage.

It’s blogs like these that make a difference so thank you for exposing the scam of Chase Sapphire cards.

You’re exactly right. Unfortunately, I’ve never heard of anyone getting an early diagnosis with pancreatic cancer. It’s always late stage. 🙁

Kellie, here’s my blog post.

I’ve also linked to you on your claims denial by Chase despite the serious life threatening travel situation you were under.

https://cleanfooddirtygirl.com/chase-sapphire-reserve-card-travel-protection-insurance-is-a-scam/

Thank you for this amazing summary about Chase Sapphire pitfall in the travel insurance benefits. I have CSR card, and recently had a flight delay causing me to miss the connection flight, and by the time we got to the destination airport, we were not able to get the reserved rental car to drive to 1.5 hour away final destination that night. The next day we had to book a new rental car whose cost was much higher than the first reservation, because of last minute booking. So I went through the claim process. I was told that the Card’s travel insurance would not over the additional cost on the rental cars, because it was not prepaid. I wish I had insisted to pay in full with the rental car that night, and then the insurance would have to reimburse the entire prepaid rental instead of the difference between the first and 2nd reservations. Because of such disappointment, I started to research more on the “travel insurance” offered by the credit cares, and I came across your article. It was very helpful. Guess what? I am just about to make full payment on my upcoming cruise trip, and this time which card I would use? Costco Citi!! And I will cancel CSR next year. Thank you for taking the time to write and summarize the difference. I hope more people are aware of pitfalls of CSR travel insurance benefits.

Similar story from me, although my loss is smaller ~$1300

I hold a chase sapphire reserve card for the past few years. I booked my round trip tickets using my card with Emirates airlines. When I was in my home country my father passed away which made me to cancel my return trip and rebook a week later, incurring a change fee and the fare difference. I thought the loss I incurred will be covered under card benefits as listed on their webpage: https://www.chase.com/card-benefits/sapphirereserve/travel

My change fee was refunded by Emirates. But Chase’s claims department denied my claim for the fare difference saying it is an ineligible expense. When I mentioned about how the expense is listed on the website as covered, i was told that the agency who handles the claims are a third party and they don’t go by what is on Chase website. I called up Chase customer service, but they denied to help saying they don’t handle claims. I feel cheated.

Is there a way that we make the other Chase customers aware of this? I am not on any social networking sites, but, does it help to take this to facebook or twitter just to prevent more people falling prey?

Griffin, I am so sorry for the loss of your father and the horrible treatment you received from Chase and their travel partners. Trip Interruption due to death of a family member is covered in every single policy I’ve ever reviewed. Like in our case, Chase failed to provide the most important element of Trip Interruption coverage which is reimbursement for the additional transportation costs that resulted from your father’s passing. Sadly, the travel insurance industry is not regulated like most other types of insurance. So basically they can make up their own definitions and coverages without adhering to any sort of industry standards. Additional/Alternate transportation expenses are the cornerstone benefit in the 50+ trip cancellation and interruption policies that I’ve reviewed. I don’t understand how Chase can continue promoting this as a card benefit when it fails to meet the basic industry standard.

This post has been shared on social media, but most people don’t really care until it affects them personally. Thousands of people have read this article; unfortunately, most of them find it AFTER they have had a similarly painful experience with Chase. 🙁

Thank you Kellie!

We had to cancel a trip to Iceland at the last minute due to illness. We got the doctor’s note and every single other requested document. It took 6 months of fighting with the Chase travel insurance provider for them to actually process and accept the documents. They just kept sending us the same email over and over, asking for documents we already provided. We lost about $3k on our trip, but we just found out that Chase is only reimbursing us $600. No explanation as to how they got that number. We provided all of the invoices and cancellation notices, totaling around a $3k loss. This was for airfare, hotel, and a couple of tours. All of which should be covered, I believe. I don’t know if its worth fighting them, especially since it sounds like they don’t really change their minds. I feel so cheated.

I am so sorry for your experience! I know exactly how you feel. You could consider filing a complaint with the department of insurance. The complaint would have to name the actual underwriter of the policy, not Chase. You could also file a complaint against Chase with the Consumer Financial Protection Bureau. It won’t change the outcome but might make you feel a little better. Also, you can always cut up your card and send it back to them with a copy of this article. Again, I’m SO sorry for your experience, but thank you for sharing it for others to learn from!

Sorry to hear about your ordeal. I am definitely bookmarking this article for the future. Are you considering legal action? It sounds like you have a strong case and it could be well worth your time to file in small claims.

Trip Interruption seems to be after you start your trip not before you started. So even the other travel insurance policies appear that they would not have covered this expense either. It seems like you rerouted the outbound portion of your trip not to return

Thank you for your comment. Trip Interruption begins on your departure date. So even though we were still in our home country, our trip had begun and Trip Interruption coverage was in place. I’m not sure what you mean by “It seems like you rerouted the outbound portion of your trip not to return.” We booked alternate flights that avoided Istanbul since it was under attack. But our destination city and return cities remained the same (Johannesburg and Atlanta). Every single other policy I’ve reviewed would have covered these expenses except for Chase (and they did’t disclose it).

From the Allianz website it states:

“A trip interruption occurs when a traveler must unexpectedly cut short his or her trip and return home. Additionally, interruption can cause you to stay at your destination longer than originally planned (not always a bad thing, right?) Trip interruption insurance can refund lost prepaid costs, minus any available refunds and up to the maximum benefit amount, and cover the cost of your extra accommodations and/or your trip home”

https://www.allianztravelinsurance.com/travel/trip-cancellation/travel-delay-trip-interruption-trip-cancellation.htm

Based on that definition, you would not have been covered with Allianz.

I have purchased travel insurance for decades and never heard of trip interruption insurance covering what you described.

Trip Interruption begins the day your trip begins. Up until the departure date, Trip Cancellation is in effect. I, too, have purchased travel insurance for decades. And after my experience, I did exhaustive research on the nuances of Trip Interruption industry standards. Here is the language from the Allianz Classic policy:

“Reasonable transportation expenses for getting to:

* your final destination or a place where you can continue your trip, or

* your original destination another way, if your travel is delayed for 24 hours or more at the start of your trip.”

Our additional transportation expenses would have been covered under the above policy or any others that I have reviewed. This is just one example of what typical Trip Interruption coverage looks like.

[…] article: Travelers Beware! Don’t Get Stranded by Chase Travel Insurance. Screw my Chase Sapphire Preferred card, I am using the premium CNB card from now on for all […]

I can’t help but ask was your trip really interrupted by the turkey attacks? Did they cancel your flight or delay it greater than 24 hours? I am guessing here, but the sad truth is probably that it wasn’t deemed interrupted by Chubb Groups definition (underwriter) since you still had a viable option but elected to reroute out of personal fear (completely understandable). Furthermore I would imagine the airline would have rerouted you if the connection through turkey was truly no longer viable.

Hi, thanks for your comment. It actually did meet Chubb’s definition of interruption and the reason for the claim was approved. Chubb simply didn’t provide coverage for alternate transportation as is customary in Trip Interruption coverage, therefore we were out of luck. In the hours after the attempted coup, the FAA canceled ALL flights into and out of Turkey for a couple of weeks. Furthermore, Turkish Air did not work with any other airlines to reroute passengers. Had we been flying another airline (U.S. based), the outcome may have been different. Between the sub-par Chase/Chubb/Allianz insurance and flying Turkish Air, it was the worst possible combination for our situation.

This was super helpful. Glad to know that I’m not the only one dealing with these issues!

We were supposed to go on a babymoon but had to cancel it due to my father’s sudden shoulder surgery so someone had to take care of the business. I filed it in on 1/25/19 and have heard from the examiner twice since that time – two weeks after I first filed and two weeks after that. Asking for the same exact documents that I’ve already uploaded – I think I’ve uploaded like 20 documents for this already. It’s like they need everything all in one place because they are unable to logically think that if A=B and B=C then A=C. It’s like y’all cant figure it out from all the documents you already requested and making it even more convoluted for yourselves by asking for more?

Anyway – its a little over $3k that we are trying to get back so we are in it for the long haul. Requested a call-back from the claims examiner but since someone else already mentioned that they haven’t had luck with that either, not really holding my breath here. Will update y’all when there is something to update!

Thanks for giving us all a place to rant and share frustrations – perhaps it’s time to take a look at Citi.

I am working through a claim for a cancelled flight, the flight was a wopping $65, that went up and turned around due to snow. It was the last flight of the night, so me and my 3 friends spent the night on the floor of the airport and caught the next flight with a different carrier at 6a the next morning (I was actually told this would not be covered but it was $100 flight.. we got hit with $150 baggage fee for skis, we still didn’t mind as it wasn’t that expensive). ANA reimbursed me the wopping $65 no problem, but what was non-refundable was the ~$500/night condo and the ~$350 private transfer we had arranged the night before.

So knowing that I pay $450 a year for my CSR, and that it has travel insurance, I open a claim. I read the initial requirements and submit everything I have expecting an examiner to call/email in a week or so explaining what else is needed. Never received follow up, call in they give me a list of a few more docs to get together, some of its ridiculous like an email from the lodging provider stating there is/was no refund, despite the T&C clearly stating no refunds within 30 days… So I get more docs and submit them… Examiner never follows up, I call in and request the examiner to call me (48hr turn around for a callback), examiner asks for 2-3 more things, which I get and provide. Today I miss a call from the examiner and get an email requesting these items:

A letter from the tour provider or common carrier that provides a breakdown of the unused prepaid flight expense, hotel, or cruise. we arranged all our own travel, I have provided them with all my invoices for the missed portions of the trip showing the total cost and my statement of that we missed the first night and the private transfer (can they not do the math?).

Documentation substantiating the reason for cancellation. I provided them with multiple certificates of cancellation from ANA which states cancelled due to weather

The refund or credit documentation was incomplete. Please provide a complete copy of verification from Common Carrier, Tour Operator, Travel Agency, or Travel Supplier (ex: airline, cruise line, hotel, etc.) showing refunds or credits for future travel. I’ve provided them with statements and emails confirming that they refunded me the wopping $65 and that I am actually looking for reimbursement for the ~$850 in other expenses lost

I more or less have given/verbally told them all of this multiple times. I am so pissed I wasted time calling into chase to provide them feedback and to threaten to cancel. I realize this benefit theoretically covers you in a lot of ways, but I also think its completely stacked against you to make it difficult to complete a claim… This is less than $1k, I am fighting it out of principle, if I had totaled a car in a foreign country not covered by my primary car insurance, I could be out 20k+ and REALLY be freaking out… I think I’ll think twice about supplemental travel insurance the next time we go abroad… the CSR coverage might in the end come through for this $850 expense, but at the end of the day if they don’t, so be it.

I feel your pain! Chase is the absolute worst! Do you have an update on your claim? On a side note, I have just filed a claim with a real travel insurer for a canceled flight and trip interruption due to illness during a recent trip. The total expenses are around $300. I am curious to see if the process will be as painful as what you and I both experienced with Chase. Hopefully it will be a more pleasant, reasonable experience dealing with people who aren’t lacking in both common sense and business ethics.

Wow…. that’s a lot of information that I need to read again. And it sucks because I got the Chase Saphire just a few years ago for our travels. So, you would recommend the Citi AAdvantage card instead – am I reading that right? Thanks for this information and continue to enjoy your travels. Also…. totally an aside and so much on your plate (and you guys do a beautiful job)….. would you consider adding picture descriptions to all of your photos/videos on your blog? I work with students with visual impairment and blindness and I will be using some of your blogs in my teaching this year. When visually impaired students access the internet they use screen readers to speak everything to them. They can’t see a picture but are told there is a picture there. They love when there is a description for the picture. Sometimes it is embedded and the description is read when the mouse hovers…… sometimes it is actually in the text of the blog. No worries though as I can totally describe your beautiful pictures. Peace, Bobbie

I would definitely consider the Citi cards. Look at the fine print in the card you choose and make sure it includes real Trip Interruption.

Also, thank you for the reminder on the photo descriptions! I will do better!

Thank you for your information. I reviewed the information on the Chase Sapphire Reserve card and there is no mention of covering expenses to get you back home. Similarly, I reviewed the information for the CITI Prestige card and they explicitly state they will pay for coverage to get you back home (“Additional costs to get the Covered Traveler home if the Trip is interrupted, as long as new arrangements are within the same class of service as the original booking, such as economy or business class.”). I have been struggling as to which card to keep and this decisively makes the decision very easy. Thank you again for posting. The nuances between the cards are so hard to distinguish.

-Rob-

Thanks for reading. Yes, that one difference makes the decision a no-brainer!

I absolutely will cancel Chase as soon as my claim is final.

On August 15, 2018 my mother was very ill I was sure we would not travel with group of friends on trip to Scandinavia and Iceland which would start on September 5. So I began the process of filing for Trip Cancelation Benefits with Chase and Costco Citi.

My mother passed away on August 29, 2018.

Costco Citi approved my claim and credited my account on September 17, 2018.

As of today, December 15, Chase still requesting for the Common Carrier’s statement to indicate the status of the account – any future credit. They also required to have statement under the airline/hotel stationary.

I am now at the point to tell them to finalize my claim based on documents they accepted. I will cancel this card and carry only Costco Citi.

If my experience help stop anyone from applying for Chase Sapphire card – that’s the cost Chase has to pay for not doing business in good faith.

I am so sorry about your mother! Thank you for sharing your painful and terrible experience so that everyone will know what kind of company Chase is. Wishing you happy travels in the future.

I am so sorry this happened to you, it could have and probably has happened to many other people. Most people probably didn’t do the digging and research you’ve done to find the information that doesn’t actually exist, and probably take what the company says as truth. Large corporations send someone “in” that has a strong vocabulary, verbal skills and a skewed moral compass that allows them to do whatever it takes to end the situation without legal ramifications. Think sociopath. They’ll lie convincingly to fit their narrative that they did nothing illegal and in no way can be held responsible. These companies can be intimidating because most people are inherently kind and in that kindness take the majority of the responsibility/blame (whether they feel unjustly treated or not) to leave a terrible situation that was no fault of their own. Chase isn’t a new company that mistakenly left crucial information out of a policy document, they have a whole legal department to make sure particular words, and information is included or NOT in this case.

What concerns me is that this was potentially a grave situation that could have ended far worse. What if someone didn’t have the resources (cash or credit) to purchase additional airfare to get them to a safe location? I think you should contact an attorney, one that will fight a potentially difficult battle because it’s the right thing to do. Remember lawyers are like doctors, you may need to get a second or third opinion. You clearly have the resolve to take it to the next level and beyond. Who knows, maybe you’ll be the reason policy and laws gets changed to protect future travelers and keep them out of harm’s way.

*I wasn’t trying to be snide with my suggestion of getting a second opinion; I’m a lawyer’s daughter and a doctor’s granddaughter. I respect and appreciate them greatly and their practicing professions.

I Love your website and the premise of it. I totally agree, learning needs to come from all aspects of life and most won/t be from a classroom. I subscribed, I am so curious how this issue is going and how it will end. Good luck and I commend you for speaking up and warning others. Thank you.

Thank you so much for taking the time to comment. You are so right!!!

I found your article very interesting because I have had bad experiences with Allianz myself, and was unable to claim a flight change cost even though my Mother was severely ill in hospital. Most recently, I rented a car in Europe, and damaged a tire. I had to replace the tire with my own money. I had relied on the car rental portion of the insurance for any damages. But the nightmare of trying to claim my money back in retrospect has made me shy of any foreign rental using the credit card collision damage waiver policy. I have made 8-9 international phone calls to Hertz abroad, ( got no help from USA hertz ) in order to get the necessary paperwork for a simple claim. Absolutely no help from Chase credit card or Allianz. You’re right. You can never actually speak directly to an adjuster. You have to leave messages and go through third, fourth and fifth party people, who care nothing about your situation,.. it’s not their money. I will admit that you’re situation was way worse than my trying to claim for a tire, but it made me want to look around for a concierge-type insurance service that would be there to help if I had unfortunately suffered more car damage, or worse. A scary thought. I shall definitely be looking into your recommendations. Thank you !

Thank you for taking the time to share your experience too. I’m glad it was just a tire in your case, but you’ve certainly experienced how unprofessional Chase and Allianz are. I can’t decide if the are incompetent or corrupt. Maybe both. Hopefully our stories will warn others to take their business elsewhere.

Sorry to hear about your ordeal. I’m currently in the midst of dealing with Chase myself. Finally, I reached a Tier 3 Supervisor who promised to move along my request for a refund for our cancelled trip due to serious pregnancy complications. We’ll see. I just sent the doctor’s note and waiting for their response. This was after 4+ hours of phone calls, conversations with 12 different representatives who seemed to purposely be fumbling in order to slow down the process or frustrate me until I gave up, lots of detailed notes and the determination to not let a corporation bully an honest consumer out of $2,300.

“We’re sorry, we gave you misinformation, we do now see that you are covered by Chase Sapphire Preferred insurance”…. “We’re sorry, we sent the email to the wrong address” (Twice?!?)….

“We’re sorry, we failed to mention you needed to file a claim with the airline as well”….

“We’re sorry, we don’t know what to tell you with regard to the airline’s response that Chase must file the claim since we were the booking travel agent and that they cannot accept a claim from you. A claim must be filed”….

“We’re sorry, our online claim form is designed to be faster than paper for your convenience, but it will not allow you to move forward if you cannot fill in information about the airline claim (which we understand you are unable to file). We’ll send you a paper claim form instead.”

I could go on and on with this frustrating loop of seemingly calculated incompetence.

The supervisor offered me 7,500 points as a compensation for my time lost, which was unexpected and appreciated. But, like I said, I’m still waiting to see if they provide good on their promise to refund our $1,212 and 91,605 points in a timely manner. I hope.

Wow! The runaround sounds very familiar. I’m so sorry for your ordeal. I hope stories like ours will help other travelers know that Chase is NOT their friend. I’d love to see travelers cut up their cards and mail them along with this post and comments to the Chase corporate office. What’s really sad is that Chase is fully aware of how substandard their coverage is, yet they continue to pay credit card bloggers to list them as THE BEST card for travelers. I seriously do not know how this is legal.

Thanks so much for sharing your story and warning others about these pitfalls.

I have been considering whether to apply for a Sapphire Preferred or Sapphire Reserve. After reading your article, I might be less likely to apply for one of these. The biggest reason I would apply for one of the Sapphire cards is the primary rental car insurance. Do you have any thoughts on this?

One of my current cards is the Costco Anywhere Visa by Citi. The fine print on trip interruption insurance appears to match what you posted in your article. I may end up using the Costco as my go-to travel card.

Another benefit where Citi surpasses Chase is the Extended Warranty. Citi offers 2 additional years, while Chase offers only 1. Citi also offers price protection and return protection. Chase axed these two benefits in August.

Thank you for reading and your feedback. Unfortunately, I haven’t compared the rental car coverage. Thanks for adding the additional information on how Citi’s benefits compare to Chase’s. That’s helpful info. As for me, my go-to cards are the Costco Anywhere Citi Visa card and the AAdvantage Citi MC.

I carry the Chase Sapphire card for a number of reasons but primary among those are the flight rewards program, which I find unbeatable, and the primary insurance provided for rental cars. I live in an area with a near perfect walk score and excellent public transportation so I do not own a car – haven’t for years – and so have no personal insurance coverage. Getting primary insurance via the card has been a major savings for me and over the past five years I’ve had two significant claims – one a total loss of vehicle – that were underwritten by the card with no hassles at all. Actually the only complaint I have is that the website used for the claim process really sucks. That said, as soon as I figured that out I just switched to calling directly and received excellent assistance.

I’m concerned to hear about the trip insurance issues. I’ve always purchased an individual policy – usually from Allianz – to cover my trips. I have a lot of travel coming up in the next twelve months though and decided to look into an annual plan for which the first quote was £180. (I’m an expat in UK) The amount convinced me to look into the Chase travel benefits which led me to this blog. Sorry to hear about your situation. I’m still trying to get a grasp of what an “unwritten” exclusion could possibly be. That makes no sense to me at all.

I will say this: In the last five years using this card it has literally saved me thousands of dollars in excess primary rental car insurance costs and in airline ticket fees. And it’s worked perfectly. In addition to the vehicle claims I mentioned previously, it included repayment in full of airfare that we lost when Monarch Air went bust last year.

I guess I’ll take a look at some annual third party insurance deals – but I’ll also hang onto the card. It seems to work well in the areas that are important to me.

I have a cruise trip coming up in a few months. Based on what you’ve written and the research I’ve been able to conduct this far, I’m leaning in favor of applying for the Citi Premier (it seems like the Citi travel card to go for if you don’t fly AA). The travel benefits and protections seem to be on point. Opening a card with a sizable bonus is best when that opening coincides with a major expenditure. In my case, that would be the cruise trip.

Sounds like a great plan. Thanks for reading and enjoy your cruise!

Kellie, just getting to read this. Wow, what an ordeal. Thanks for sharing the details of it. We too have the same Chase card. Sounds like you’ve researched all the other credit card plans and feel the CitiCard is best. If so, we’ll likely also make the switch. Also, sounds like even so, that you purchase the additional medical travel policies you suggested. Do I have it right?

CitiCard has recently reduced their benefits to $5,000 max, so it would be fine for smaller trips but not sufficient for a major trip. However, after our ordeal I’m a bit skeptical of any credit card coverage. Maybe something small like booking flights for a domestic getaway would be fine, but for anything else, I purchase a real trip insurance policy.

Even that isn’t as simple as it might seem though. I now painstakingly read the fine print and try to think of every imaginable situation and how the insurer will try to hose you. I just purchased a policy yesterday and chose one over another because they have a provision to reimburse for redeposit fees for frequent flier miles if that is how you booked your tickets.

What I can tell you for sure is that I will NEVER do business with Chase, Chubb or Allianz again in any capacity because they have proven to lack integrity and common sense in their business practices.

Thanks for reading and commenting!

[…] I quickly called our Chase travel insurance to confirm trip interruption benefits and get instructions on how to proceed. Chase’s travel […]

HoKo

Ugh, having dealt with these call centers before I can picture this exact scenario unfolding. Sorry to hear about your crappy experience.

I went and looked at the Chase Sapphire Reserve Trip Interruption benefits section and indeed there isn�t any mention of lack of coverage for alternate travel arrangements when utilizing the trip interruption benefits. That is pretty outrageous.

I don�t think the call center employees were intentionally feeding you incorrect info. I think it�s more likely that these are low-wage employees without a ton of training and they just don�t have the correct info. That being said, it is ridiculous that they don�t provide this sort of critical info in the benefits guide or provide the CSR�s with a FAQ that addresses these sort of questions. Your question was not some sort of super niche �who could�ve anticipated someone asking this question� sort of scenario. As you pointed out, alternate travel arrangements are probably one of the most commonly asked questions that anyone would ask in this sort of situation.

Some other points/questions:

1. The airline didn�t offer to re-route you so that you could avoid Istanbul?

2. Have you considered taking them to court/arbitration. Sometimes that is what is needed in these sorts of situations to show them you are serious (that being said, you may not win the case since this is a grey area since alternate arrangements are not addressed one way or the other in the contract)

3. This reminds me of how health insurance companies always say how �benefits info is not a guarantee of coverage� and you never know how/if they are going to cover your medical procedure until it has already taken place. Like how can I decide whether or not to go ahead with the procedure if you can�t tell me it�s gonna be covered or not.

Kellie

4WornPassports@gmail.com

In reply to HoKo.

Thanks for your thoughtful reply, HoKo. Unfortunately, we were flying on Turkish Air and all of their flights go through Istanbul. They did not offer to rebook passengers whose ultimate destinations were outside of Turkey on other airlines. Maybe they don�t have those sort of affiliations? I�m not sure which airlines work together in crisis situations and which ones do not. When the attacks happened, I called Chase from the ATL airport. Based on our multiple conversations and what is customary with regard to Trip Interruption, we booked alternate flights on Delta bypassing IST completely. In fact, we lost the first three days of our trip because we couldn�t find flights that were within the benefit limit they told me we had until three days later. I didn�t file a claim for those three days that we lost because I was able to cancel those rooms without penalty.

The worst part of the entire ordeal is that we bent over backwards to try to minimize the amount of the Trip Interruption claim we were going to file, and Chase still hosed is. We were actually doing our best to advocate for the insurance company (crazy, right?). For instance, we could have left the airport when the bombings started and filed a claim for the Turkish Air flights (~$4,000), but after much pressure from a bunch of us passengers, TA agreed to refund the flights for anyone who stayed and processed the refund on site. Anyone who left the airport would not be eligible for a refund. So we opted to stay and insist on a refund so that the only amount we would be claiming with Chase would be the difference in the cost of the original flights and the new flights. The new flights cost over $9,000 for our family and we only filed a claim for the difference. We were the very last passengers to be processed and didn�t leave the airport to return home until 1 AM. Since it was 1 AM it was too late to safely drive home (we live 2.5 hours from ATL) so we had to get a last minute room in ATL. It cost us ~$250. They denied that as well. Again, we were looking out for the insurance company by forcing the refund with TA and it caused us to incur a $250 hotel room that we could have avoided if we had simply returned home.

By definition, Trip Interruptions incur additional expenses. None of which are covered by Chase, yet they fail to disclose this.

Long story short, Chase and its travel partners failed colossally at every point of this crisis. Their �Trip Interruption� coverage doesn�t come close to what is industry standard, yet they continue to market themselves as THE credit card for travelers.

Just reading you story, now, wonder if you’ll respond.

Funny I just opened a Chase Preferred account, precisely for their travel insurance. I was tired of paying $900 for something I never use but realize it is necessary.

I think it was unforgivable that they failed to inform you correctly. THey should have an emergency # meant to handle precisely these questions, correctly!

So here is my wishful thinking question, because I think all credit cards will screw you if given the opportunity.

Were you talking about the “Chase Sapphire Preferred” card as opposed to just the Chase Sapphire Card?

Hi Ellen. Thanks for reading. Yep, my card was the Chase Sapphire Preferred. Chase should truly be ashamed of themselves for promoting their card as THE card for travelers. They have proven to lack both integrity and common sense when it comes to their travel “benefits”. Ironically, the Citi AAdvantage MC does provide alternate transportation under their Trip Interruption coverage, but they do not get listed as one of the recommended cards for travel insurance by all the credit card websites because they don’t pay affiliate fees/commissions. In other words, all of the credit card “expert” websites that rank the Best Card for ______ get paid to list certain cards. If you pay close attention, you’ll notice that Citi cards are rarely on the lists, but the lists are full of Chase cards. That’s because Chase pays referral/affiliate fees and Citi typically does not. The Citi AAdvantage card recently reduced its Trip Cancellation/Interruption benefits to $5000, so it’s probably not suitable coverage for a big trip, but it is certainly good enough for smaller trips. You are exactly right that Chase/Chubb should provide an emergency number that is staffed by people who are required to give accurate benefits info. The fact that this is not common practice is asinine!

Of course I would love it if travelers would cut up their Chase Sapphire Preferred cards and mail them along with a copy of my article to the Chase, Chubb, and Allianz corporate offices. 😉